After 40 years of reform and opening up, Deng Xiaoping took the highly open Hong Kong as a model and once said that he would create several "Hong Kongs" on the mainland. When the bonded zone was established in 1990, there was a suggestion to name it a "free trade zone" with reference to international examples, revealing the original intention of pursuing free trade. After several considerations, the Chinese name was finally adopted as "Bonded Zone" with Chinese characteristics, and the English name was changed to "Free Trade Zone".[1]Later, export processing zones, bonded logistics parks, cross-border industrial parks, bonded port areas and comprehensive bonded zones were established, a total of six special customs supervision areas to promote free trade. After many rounds of reforms, China has persisted in its determination to open its market and upgraded its free trade zone, which was dubbed an "experimental" area in recent years. The free trade port is expected to become a touchstone for a new round of opening up.

The conceived free trade port is a special economic functional zone with "a higher level of openness, a better business environment, and a stronger radiation effect." After the report of the 19th National Congress proposed that "in the future, free trade zone pilot zones will be given greater autonomy in reform and explore the construction of free trade ports," Vice Premier Wang Yang called Hong Kong, Singapore, Rotterdam and Dubai as examples, explaining that "free ports are located in a It is a special area within the country (region) where goods, capital and personnel can enter and exit freely, and most goods are exempt from tariffs." Although the free trade port is expected to expand to inland ports and airports, coastal and riverside ports may initially be used as pilot projects. Therefore, many free trade zones with ports, including Shanghai, Tianjin, Zhejiang, Sichuan, Fujian and Guangdong, have drafted proposals Report to the State Council.

expand service tradeGuangdong Free Trade Port

The Guangdong Free Trade Zone has made good use of the reform space of opening up to the outside world and has achieved remarkable results in attracting investment since its establishment in 2015. From January to November 2017, the actual utilization of foreign investment reached 5.74 billion US dollars, which was the largest amount of all free trade zones in the country during the same period.[2]. As of the end of 2017, there were a total of 196,000 new enterprises, ranking first among all free trade zones.[3]Relying on the two major ports of Nansha Port and Shekou Port, the Guangdong Free Trade Zone has the most favorable conditions to deploy free trade port planning. Shekou Port's container throughput growth rate leads the city of Shenzhen. Together with Yantian and other ports, Shenzhen Port firmly ranks as the third largest container port in the world. Nansha Port’s astonishing growth has also helped Guangzhou Port become the seventh largest container port in the world. Coupled with Hong Kong, which ranks fifth, the Greater Bay Area accounts for three of the world's seven largest container ports, and the port trade is unparalleled in its prosperity.

In 2017, the State Council announced the "Plan for Comprehensively Deepening the Reform and Opening-up of the China (Shanghai) Pilot Free Trade Zone" and took the lead in implementing the regulatory system of "liberation on the first line and control on the second line" to establish a free trade port, which has significant implications for the construction of the Guangdong Free Trade Port. . "First-line liberalization" means that overseas goods can enter free trade ports freely without customs supervision; "second-line control" means that when goods enter domestic non-free trade port areas from free trade ports, they must use safe and efficient methods to be controlled by customs Supervision. Although Hong Kong is a free port with no distinction between first-line and second-line customs, its highly liberal cargo control is worth learning from Guangdong. Hong Kong pursues a zero-tariff policy and does not impose tariffs on imported and exported goods (except for four categories of taxable goods: alcohol, tobacco, hydrocarbon oils and methanol). The benefits and convenience brought by eliminating the need for tariff assessment have enabled Hong Kong to become the seventh largest commodity trading economy in the world.

Using information technology to simplify customs clearance procedures is another key point in relaxing the regulatory system, represented by Singapore's launch of TradeNet, the world's first national one-stop electronic customs clearance system, in 1989. This system allows importers, exporters and shipping companies to connect with all 35 relevant departments to handle trade procedures such as signing, inspection, and taxation. TradeXchange, launched in 2007, is a platform that connects the trade and logistics industries, providing electronic information on port affairs and freight, and connecting to foreign customs clearance and supervision systems. The new generation of national trade information platform National Trade Platform will integrate the above two systems and establish an innovative platform to allow service providers to provide value-added services to support business needs.

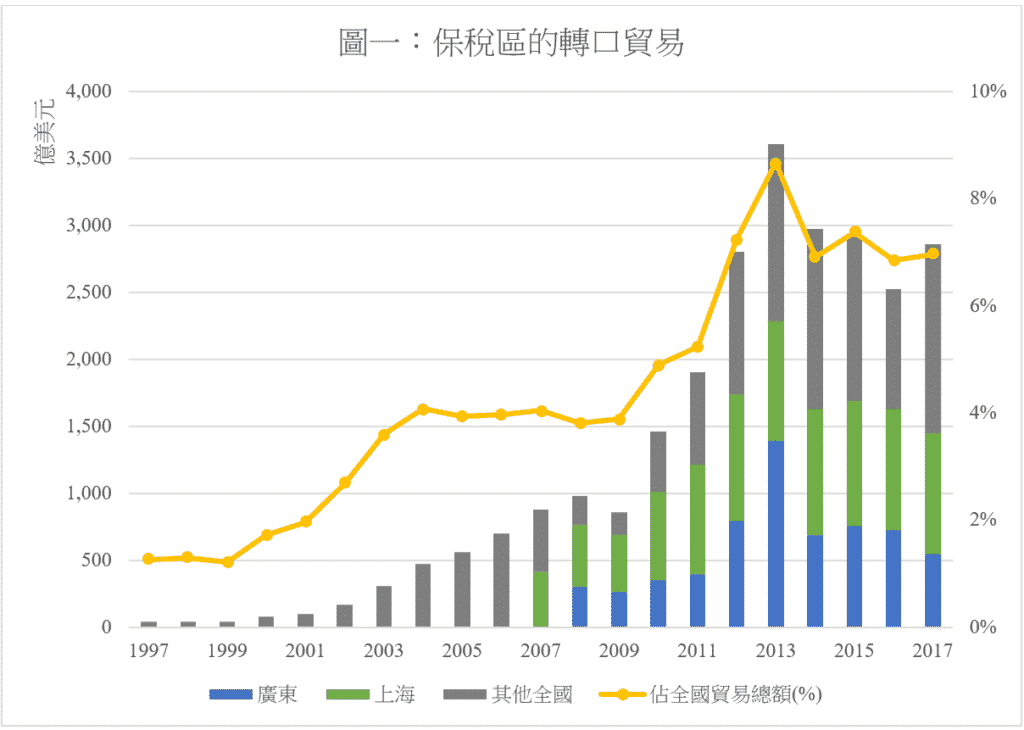

From the international experience of commodity trade, the free trade port will eventually shift from import, export and processing trade to re-export trade and offshore trade. Domestically, special customs supervision areas aimed at opening up to the outside world are also developing in this direction (since the six types of supervision areas all provide bonded functions, they are broadly referred to as bonded areas below). Figure 1 depicts the importance of re-export trade in the bonded zone to the country's foreign trade. It surged from US$4.1 billion in 1997 to a peak of US$360.4 billion in 2013, and then fell back to US$285.8 billion in 2017. The proportion of China's foreign trade increased from 1.3% After soaring to 8.7%, it eased to 7%. The bonded zones in Shanghai and Guangdong each account for about 30% of the country's re-export trade.

Figure 1: Entrepot trade in the bonded zone

Source: General Administration of Customs of China, "China Customs Statistics", historical years.

Re-export trade and offshore trade are conducive to the development of a variety of trade-related services, including services directly related to the circulation of goods, such as logistics, warehousing, transportation and exhibitions, as well as services not directly related to the circulation of goods, such as finance and insurance. , telecommunications, business services and professional services. Rotterdam is the largest seaport in Europe and an entrepôt port famous for its value-added port services such as logistics and transportation. Its warehousing and distribution functions attract re-export goods from all over the world. The developed intermodal transport network of railways, roads and inland waterways has made Rotterdam a shipping and logistics hub in Europe, and has also made the Netherlands the fifth largest exporter in the world, of which non-Dutch products account for more than 80% of its exports.

Access thresholds have a decisive impact on the development of service trade, and investment liberalization is essential in the construction of free trade ports. At present, CEPA allows Hong Kong and Macao service providers to operate sole proprietorships in some service fields on the mainland. Most industries that allow joint ventures limit their shareholding to no more than half. Trade barriers can be further dismantled. Dubai has designated more than 30 free zones to provide an ideal business base for foreign businessmen. Most of these free zones have specialized industries, such as finance, healthcare, education, media and e-commerce. Foreign businessmen can wholly own enterprises in the zone, with complete tax exemption on imports, exports, and salaries. All capital and profits are returned to the country of origin, and they also enjoy a 50-year profit tax exemption.

In the service trade, financial services are the top priority, so the free trade port shoulders the mission of financial internationalization and seeks ways to solve the free flow of cross-border funds. Adjacent to Hong Kong, the world's largest RMB offshore center, the Guangdong Free Trade Port will have unique advantages to explore ways to open up the capital account. As of the end of 2017, the Guangdong Free Trade Zone, which is preparing to be upgraded to a free trade port, has introduced more than 63,000 innovative financial and quasi-financial companies, of which 2,914 financial and quasi-financial companies have settled in Hong Kong. The cumulative amount of cross-border RMB settlement handled by Guangdong Province reached 13.87 trillion yuan, of which the amount of cross-border RMB settlement handled with Hong Kong reached 9.45 trillion yuan.[4]In the early days of the establishment of the free trade port, in order to control the risks of comprehensive circulation of RMB and open capital account, the free circulation of funds within a certain scale should be tested, and then in the long term, RMB pricing and settlement should be encouraged, offshore RMB within the country should be promoted, and the return flow of RMB overseas should be attracted.

Hong Kong’s experience as an international trade hub

Hong Kong has no advantages in handling and storing goods. Container terminals require a lot of land, and Hong Kong is far from mainland supply sources, making it difficult to compete with other ports in the Greater Bay Area in terms of cargo volume. Hong Kong's container throughput has been surpassed by Shenzhen and may be surpassed by Guangzhou in the future. In fact, Hong Kong has transformed into high-value logistics. The value of air cargo accounts for 41% of Hong Kong’s foreign trade, far exceeding the 19% of sea and river transport. Hong Kong Airport's international cargo volume has ranked first in the world for many years in a row. The cargo volume far exceeds the entire Guangdong Province, and the passenger volume also exceeds Guangzhou Baiyun Airport and Shenzhen Bao'an Airport. In 2018, it was awarded the pharmaceutical cold chain transportation certification by the International Air Transport Association. It is the fifth airport in the world to obtain the certification and actively develops high-value logistics.

Although the current GDP of Hong Kong, Guangzhou and Shenzhen is very high, because Hong Kong's population is far less than that of Guangzhou and Shenzhen, in the long run, Hong Kong's economic scale cannot be compared with Guangzhou or Shenzhen. Hong Kong's economy can only win based on quality rather than quantity. . Hong Kong's economic advantage lies in its high-quality service industry that leads the country: the service industry accounts for 92.6% of Hong Kong's GDP, which is much higher than the 54.6% of the Pearl River Delta. It is precisely because the construction of the free trade port not only requires the development of transportation services, but also requires the support of high-quality trade support services. Therefore, even if the three major ports of Hong Kong, Guangzhou and Shenzhen stand side by side, the advantages of high value-added service industries such as intermediary services, financial insurance, legal arbitration and commercial services Still gives Hong Kong a unique role.

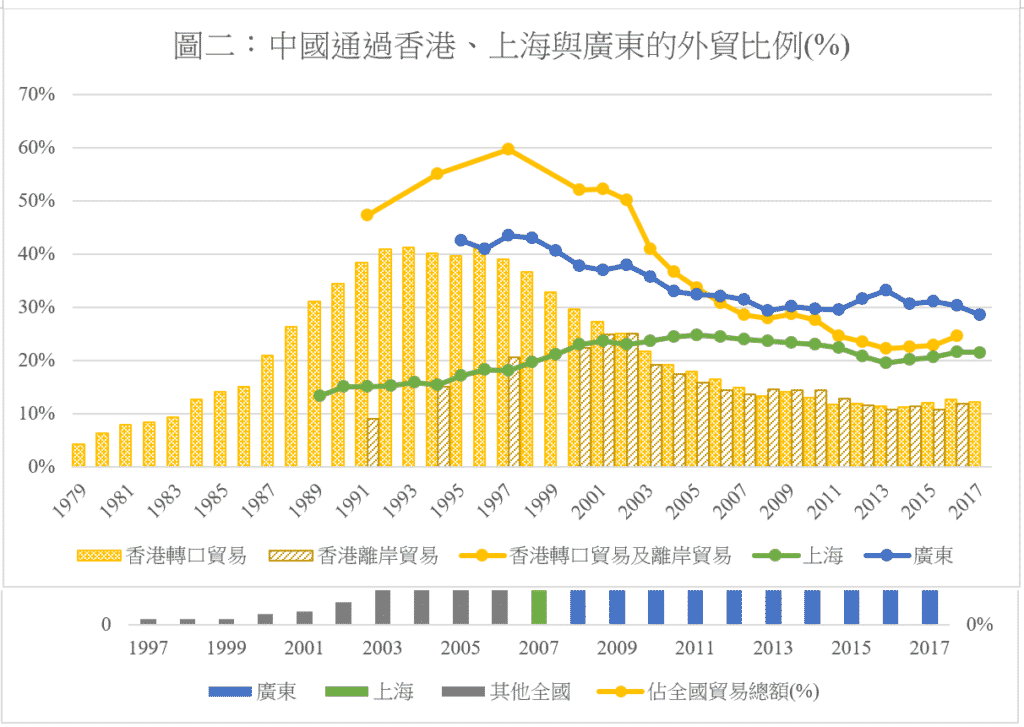

Figure 2 shows the trend of China’s foreign trade proportion through Hong Kong, Shanghai and Guangdong. With the rise of the "front shop and back factory" model, China relied on Hong Kong to handle foreign trade in the early days of reform and opening up, and the proportion surged to 60% in 1997. This abnormal proportion reflected the serious lag in China's service industry. Subsequently, the "retreat from the second to the third" policy and the rapid development of seaports led to the decline of the "front shop and back factory" model. China's foreign trade completed by Hong Kong dropped to about 20%, of which half was offshore trade and the other half was re-export trade. Shanghai and Guangdong account for about 20% and 30% respectively. Offshore trade uses Hong Kong's intermediary services, while entrepot trade uses Hong Kong's intermediary services and transportation services. Hong Kong's offshore trade surpassed re-export trade for the first time in 2008, demonstrating that Hong Kong can overcome the obstacle of land shortage and leverage its advantages in high value-added trade services.

Figure 2: Proportion of China’s foreign trade through Hong Kong, Shanghai and Guangdong (%)

Source: General Administration of Customs of China, "China Customs Statistics", historical years; Census and Statistics Department of Hong Kong Government.

Comparing the rise and fall of the "front shop and back factory" model, it is not difficult to find that about half of the mainland's re-export trade handled through Hong Kong is related to the transfer of Hong Kong's production chain to the mainland. In recent years, wages on the mainland have risen, coupled with rising international protectionism. Against the background of the country's full-scale implementation of the "One Belt, One Road" initiative, private enterprises, Hong Kong businessmen and foreign businessmen are also moving production chains located in the mainland to Southeast Asia and South Asia, once again stimulating Re-export trade in Hong Kong and the Greater Bay Area. Hong Kong's exports to countries along the "Belt and Road" have grown rapidly in recent years, and the vast majority of them are products re-exported from the Mainland through Hong Kong. Taking Vietnam as an example, the overall export value in 2008 was only US$2.8 billion. After just nine years, the value of goods increased more than three times to US$10.2 billion in 2017, surpassing traditional markets such as Germany, Singapore and South Korea, and becoming Hong Kong's third largest exporter. Six major markets. As the local service industry in Guangdong becomes more mature, it can also develop re-export services and replace some of the functions of Hong Kong companies.

As an international trade center, Hong Kong's function has been upgraded from traditional re-export business to a service hub for regional supply chain management. China's foreign trade handled by Hong Kong has rebounded from the bottom to 25% in 2016 (see Figure 2), which is not unrelated to Hong Kong's becoming a service hub for the production chain of the "Belt and Road" region. Many mainland companies have set up international departments to handle business outside China, and Hong Kong is a popular location for these international business headquarters. In 2017, 154 mainland companies set up regional headquarters in Hong Kong, an increase of nearly 62% from 95 ten years ago. There were 1,264 mainland companies with offices in Hong Kong, an increase from 722 ten years ago. Close to 73%.[5]After three years of development, Hong Kong businessmen have also actively developed business in the Guangdong Free Trade Zone. By the end of 2017, a total of 10,489 Hong Kong and Macao companies had settled in the zone.[6]

Bonded Zone and Free Trade Portchallenge

In the 28 years since the first bonded zone was established in 1990, a variety of newly established bonded zones have spread across the country. However, only a few of them have completed their historical tasks and been cancelled. As a result, the total number has continued to grow to 176. Some of the functions of the six types of bonded zones are similar. For example, bonded logistics parks, cross-border industrial parks, bonded port areas, and comprehensive bonded zones all have the functions of bonded warehousing, international distribution, global procurement, international transit, and re-export trade. However, there are differences in licensing rights, business types, and Tax refund arrangements are all different, and the system is complex and difficult for foreign businessmen to understand. The various bonded zones, free trade zones in recent years, and free trade ports in the future all require the participation of many management committees and officials in management, and can easily become self-perpetuating and inflated vested interest groups. How to straighten out the arrangement of stacked buildings among the free trade port, free trade zone and six types of bonded zones will be a huge challenge.

In addition to more than a hundred bonded areas, there are also countless bonded warehouses. These special customs supervision areas and places are prone to false trade and evasion of foreign exchange controls. Combating counterfeiting and foreign exchange evasion requires strict customs supervision, and the cost of supervision cannot be ignored. The re-export trade in the bonded zone has declined from the peak in 2013 (see Figure 1). However, after 2013, it was the period of establishment and expansion of the free trade zone. Re-export trade is exactly one of the development goals, but many of them fall within the scope of the free trade zone. However, the bonded zones in Guangdong have recorded a sharp decline. It is believed that the main reason is that the bonded zones in Guangdong (especially the Futian Free Trade Zone) have generated a large amount of false trade, so the central government has tightened prosecutions since 2013. In the re-export trade in the bonded zone, the value of imported goods often far exceeds the value of exported goods. In 2017, the import of entrepot trade in bonded zones across the country was US$171.3 billion, while exports were only US$100 billion. Over-declaring imports and under-declaring exports is also the most common way to evade foreign exchange.

Customs blockade is a double-edged sword for development. It will help warehousing and logistics businesses, but it will hinder the financial industry and high-end service industries. In order to facilitate isolation, bonded zones are usually far away from the central business district and have inconvenient transportation. However, the financial industry and high-end service industry need to be located in the center of the business to allow high-end talents to contact each other and exchange views. Otherwise, their operational efficiency will be greatly reduced. Financial business requires account and accounting supervision to control onshore and offshore financial flows. Customs blockades only control the flow of goods and do not help control financial risks. The main purpose of China's establishment of free trade ports is to develop the financial industry and high-end service industries. These industries should not be concentrated in "districted" regulatory areas. Logistics, warehousing, transportation and exhibition services that are directly related to the circulation of goods can be provided in the bonded zone. High-end services that are not directly related to the circulation of goods, such as finance, insurance, telecommunications, business services and professional services, should operate in the business district of the city center. The successful development of the free trade port requires comprehensive cross-regional cooperation between the regulatory area and the central business district. In 2014, the Shanghai Free Trade Zone expanded its scope from the bonded zone far away from the city center to Lujiazui in the center of Pudong. It is a necessary development to move from the bonded zone to outside the bonded zone.

Guangdong and Hong KongAustraliafree trade portDistrict Exploration

With the development of the Guangdong-Hong Kong-Macao Greater Bay Area, the three port areas can collaborate to build the Guangdong-Hong Kong-Macao Free Trade Port Area. The Hong Kong-Zhuhai-Macao Bridge and the Shenzhen-Zhongshan Corridor have been opened to traffic. The flow of people and logistics in the Greater Bay Area will become more frequent. Each city can divide labor according to its own characteristics and can undertake different functions in maritime, air and land transportation. Nansha is a domestic trade port for direct coastal transportation of goods. Hong Kong can continue to play the role of an international transit port for cargo distribution in South China and develop high-value-added shipping and shipping financial services. Shenzhen Airport's connectivity for domestic flights and Zhuhai Airport's carrying capacity for private jets can also alleviate the dilemma that Hong Kong Airport's third runway will not be opened until 2022.

All in all, from bonded zones to free trade zones, China has tried many reforms to promote free trade, but has not yet achieved full success. Judging from Hong Kong’s experience, free trade ports can eventually be upgraded to international trade service hubs. However, mainland free trade ports are derived from free trade zones, and the implementation plan will have certain characteristics and restrictions. Trade support services are born of free trade ports, but they are not suitable to exist in free trade ports. Only cross-regional integration inside and outside Hong Kong can break the barriers of customs blocks. The process of reform and opening up will not be suspended, tariffs will be further reduced, customs supervision will be modernized, and special economic zones and various special areas should be transitional rather than long-term arrangements. After fully opening up market access and implementing national treatment, the role of free trade ports should be weakened rather than strengthened. Hong Kong and Macao are mature free trade ports. The Guangdong Free Trade Port under construction still needs to be explored in practice to keep up with the pace of comprehensive liberalization and form a huge Guangdong, Hong Kong and Macao free trade port area.

Song Enrong, Deputy Director of the Shanghai-Hong Kong Development Joint Research Institute of the Chinese University of Hong Kong and Co-Convener of Democratic Thoughts (Research)

Pan Xuezhi Research Assistant, Shanghai-Hong Kong Development Institute, The Chinese University of Hong Kong

[1] Ruan Yanhua and Ren Shuwei, "The Bonded Zone Chasing "Freedom"", Development Magazine, Issue 12, 2012, http://www.pudong.gov.cn/shpd/news/20160911/006005021009_4e137a79-a5dd-4b0b-b963- f7e152ce7cd7.htm.

[2] Ministry of Commerce of the People’s Republic of China, "[2017 year-end review of business work Part 4] Actively and effectively utilize foreign capital to promote high-quality economic development", January 3, 2018, http://www.mofcom.gov.cn/article /ae/ai/201801/20180102693508.shtml; "Guangdong's new round of opening up: basically establishing a new open economic system in the next five years", "21st Century Business Herald", January 26, 2018, http://epaper. 21jingji.com/html/2018-01/26/content_79349.htm.

[3] "Guangdong Free Trade Zone actively explores institutional innovation to release corporate vitality", Nanfang Daily, December 30, 2017, http://www.gd.xinhuanet.com/newscenter/2017-12/30/c_1122188495.htm.

[4] "Guangzhou-Hong Kong Financial Cooperation Promotion Conference holds the first cross-border promotion of Guangzhou finance in Hong Kong", Nanfang Daily, January 16, 2018, http://epaper.southcn.com/nfdaily/html/2018-01/16/ content_7697243.htm.

[5] The data comes from the Census and Statistics Department of the Hong Kong Government.

[6] <incredible! This district in Guangzhou has won so many national “champions”, Southern Net, February 6, 2018, https://m.21jingji.com/article/20180206/herald/25a6d4d402043d5b566ccc98214b1eb4.html;, Hengqin New District Management Macao Affairs Bureau of the Committee, "2017 Work Summary and 2018 Work Plan", February 9, 2018, http://zwgk.hengqin.gov.cn/macao/zfgzbg/201802/c22d599522d14e6e9b2d91c1a1fb76bf.shtml; "Promoting Guangdong More than 7,100 Hong Kong companies registered in Qianhai, Shenzhen under the construction of the Hong Kong-Macao Greater Bay Area, Xinhua News Agency, February 26, 2018, http://www.xinhuanet.com/fortune/2018-02/26/c_1122456951.htm .