Summary:

The "Front Shop and Back Factory" model has driven the economic development of the Pearl River Delta and transformed Hong Kong into a world-class service hub. With the rapid development of the mainland's economy, Guangdong has gradually replaced the services provided by traditional Hong Kong companies with local service industries. However, Hong Kong has also developed a high-quality service industry. Looking to the future, through the coordinated development of the modern industrial system, the integration of the Greater Bay Area will shift from vertical integration to horizontal integration, which can generate greater trade and investment. Hong Kong's economic size has its limitations, and we can only win by quality rather than quantity. Hong Kong should focus on developing high value-added trade services and cooperate with other airports in the region to maintain the competitiveness of maritime and shipping services and upgrade to a service hub for regional supply chain management. At the same time, we will seize the opportunity of national financial reform and the rapid economic development of Asia, and cooperate with professional services to become a global financial center. Even if innovation and technology starts slowly in Hong Kong, it can still catch up and eventually realize the Greater Bay Area industrial chain of "created in Hong Kong, trial production in Shenzhen, and mass production in the Pearl River Delta", creating a world-leading international innovation and technology center. In the long run, Hong Kong's role will go beyond finance, professional services, shipping and logistics, and legal arbitration to become a diversified external platform for exerting "soft power" in the country's foreign economic strategy.

1. The integration of the Greater Bay Area will shift from vertical integration to horizontal integration

(1) The "Front Shop and Back Factory" model transforms Hong Kong into a world-class service hub

The Guangdong-Hong Kong-Macao Greater Bay Area is the most open and affluent area in my country and has the conditions to build an international first-class bay area and a world-class city cluster. The GDP of the Guangdong-Hong Kong-Macao Greater Bay Area exceeds US$1.3 trillion, which is close to the US$1.6 trillion of the New York Bay Area and the US$1.5 trillion of the Tokyo Bay Area, and far exceeds the US$800 billion of the San Francisco Bay Area. The Guangdong-Hong Kong-Macao Greater Bay Area has the conditions to become one of the four Greater Bay Area urban agglomerations in the world.1However, the per capita GDP of the Guangdong-Hong Kong-Macao Greater Bay Area is only about US$20,000, which is only half or less than that of other international bay areas. The Guangdong-Hong Kong-Macao Greater Bay Area needs to work hard to develop in order to reach a world-class advanced level.

Although the Guangdong-Hong Kong-Macao Greater Bay Area (hereinafter referred to as the Greater Bay Area) has huge development potential, it also has inherent development obstacles. Due to the "one country, two systems" arrangement, Hong Kong and Macau are independent customs territories with independent borders, customs clearance procedures, and immigration and tourist controls. There are inevitably certain obstacles to the flow of factors between the Pearl River Delta and Hong Kong and Macao. In addition, Hong Kong and Macao are both free market economies, but the economy of the Pearl River Delta has always been regulated by national plans. Economic coordination between Hong Kong, Macao and the Pearl River Delta has also been difficult. There are also many contradictions in the planning of the nine cities in the Pearl River Delta. For example, each city hopes to build its own port and airport. Guangzhou and Shenzhen are both separately planned cities, and the Guangdong Provincial Government has difficulty in overall coordination. The Pearl River Delta has long had the problem of duplication of seaports and airports, which has been difficult to solve.

Over the years, the Guangdong Provincial Government, the National Development and Reform Commission and the Hong Kong and Macao SAR governments have repeatedly designed mechanisms to coordinate the development of the Greater Pearl River Delta, including the "Pan-Pearl River Delta Regional Cooperation Framework Agreement" established in 2003/04 and the "Pearl River Delta Regional Reform" formulated in 2008. Development Plan Outline. However, due to the innate obstacles mentioned above, the effects of these coordination mechanisms are not satisfactory. The further development of the Greater Bay Area coordination mechanism also requires the joint efforts of the central government, the governments of Hong Kong and Macao, and the nine municipal governments of the Pearl River Delta.

The Greater Bay Area includes the two special administrative regions of Hong Kong and Macao and nine cities in the Pearl River Delta. Hong Kong's economic volume ranks among the top, while Macao's economic volume is only one-seventh of Hong Kong's. Due to space limitations, this article will not discuss the role of Macao's economy in the Greater Bay Area. It will only focus on Hong Kong's role in the Greater Bay Area, including how Hong Kong and the Pearl River Delta divide their labor according to their own industrial advantages to pursue win-win cooperation, especially It is Hong Kong that supports the Pearl River Delta with its high-quality service industry, coordinates the development of modern industrial systems, and consolidates Hong Kong's position as a service hub in the Greater Bay Area and the Asia-Pacific region.

Hong Kong is the most open city in the country and an international financial center and service hub. The successful collaboration between Hong Kong and the Pearl River Delta is the key to the development of the Greater Bay Area. Since the reform and opening up in 1979, Hong Kong and the Pearl River Delta have developed a "front shop and back factory" model. A large number of Hong Kong's manufacturing industries have moved to the Pearl River Delta, establishing a world factory in the Pearl River Delta. For China, this world factory has created a large number of processing export and employment opportunities and has become the engine of China's development. For Hong Kong, this world factory requires the support of a large number of producer services, which has stimulated the development of advanced modern financial services, trade services, transportation and logistics services, and commercial and professional services in Hong Kong, transforming Hong Kong into a world-class service hub.

(2) Horizontal integration produces far more trade and investment than vertical integration.

The Pearl River Delta's economy is developing rapidly, and the gap between its development level and that of Hong Kong is narrowing. As a result, the development model of "front shop and back factory" is being challenged. With the economic development of the Pearl River Delta, there is a labor shortage in the Pearl River Delta, and workers' wages have skyrocketed. The labor-intensive processing industry in the Pearl River Delta needs to be upgraded and transformed. On the other hand, the producer services industry in the Pearl River Delta is also developing rapidly. For example, Shenzhen and Guangzhou have built high-efficiency container terminals to compete with Hong Kong. Hong Kong's service industry also needs to be upgraded and transformed.

With the rapid economic development of the mainland, the integration of Hong Kong and the Pearl River Delta will soon transform from vertical integration (that is, the integration of developed and developing regions) to horizontal integration (that is, the integration of developed regions). It is generally believed that horizontal integration is prone to competition and that the rapid economic development of the Mainland will be detrimental to Hong Kong. This is actually a big misunderstanding. Judging from international experience, the trade and investment generated by horizontal integration actually far exceed that of vertical integration. Most of global trade and investment are conducted between developed regions, rather than between developed and developing regions. Rich markets have more room for development than poor markets. Therefore, the development of the mainland's economy should bring more trade and investment opportunities to Hong Kong, not less. In addition, the differences in culture and living habits between developed and developing regions are large, and integration is prone to cultural conflicts and frictions, which is not conducive to deeper integration of the service industry.

The economic development of the Mainland has caused some of the functions of Hong Kong companies to be replaced. Competition between the two places is inevitable, but competition can bring about progress and division of labor. If Hong Kong reaches the world's leading level in a few specialty products, processes or services (such as Swiss watches or banking services), it can gain maximum economic benefits through the development of the Greater Bay Area. The Pearl River Delta and Hong Kong each have their own characteristics and huge structural differences. The complementary opportunities between the two places should outweigh the threats of competition. The key factor in whether Hong Kong people can seize these opportunities is whether Hong Kong can continuously improve its competitiveness, innovate and seize the opportunities of the rapid development of the mainland.

The "Framework Agreement on Deepening Cooperation between Guangdong, Hong Kong and Macao to Promote the Construction of the Greater Bay Area" clearly explains the industrial advantages and division of roles between Guangdong and Hong Kong: Guangdong must "build a technology and industrial innovation center and a base for advanced manufacturing and modern service industries", Hong Kong It is necessary to "consolidate and enhance Hong Kong's status as the three international centers of finance, shipping, and trade, strengthen the status of the global offshore RMB business hub and the function of the international asset management center, promote the development of professional services and innovation and technology, and build international legal and resolution services in the Asia-Pacific region." Dispute Service Center". This article discusses the role of Hong Kong's service industry in the coordinated development of a modern industrial system in the Greater Bay Area based on the positioning of Hong Kong's role in the Framework Agreement.

2. Economic indicators of various cities in the Greater Bay Area and the achievements and limitations of “front shops and back factories”

(1) The significance of the economic indicators of various cities in the Greater Bay Area

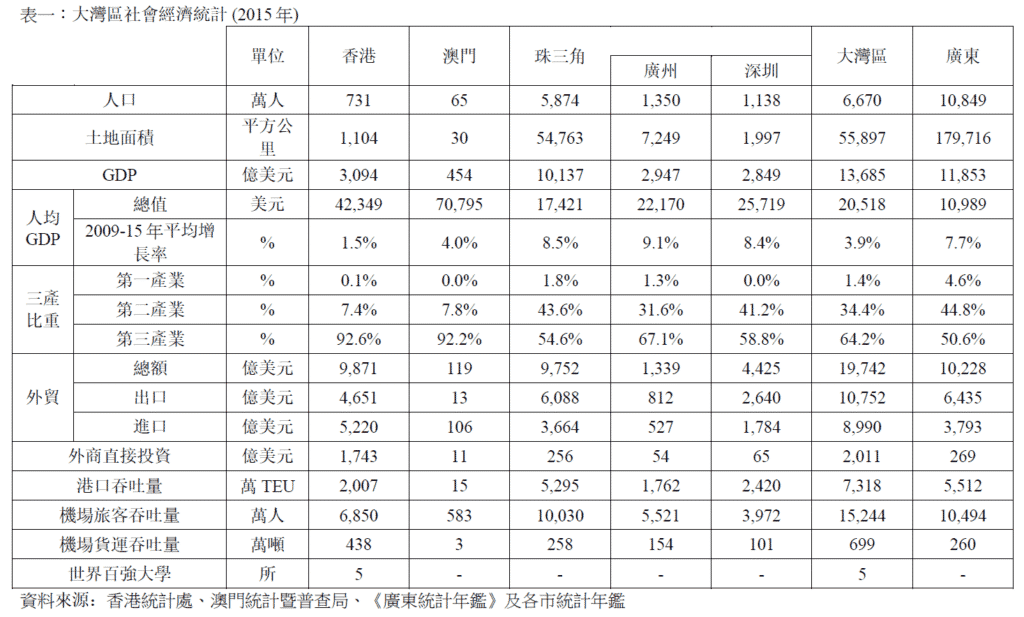

Table 1 shows the main economic indicators in 2015 for the two special administrative regions of Hong Kong and Macao in the Greater Bay Area and the nine cities in the Pearl River Delta.2The population and land area of the nine cities in the Pearl River Delta are 54% and 31% respectively of Guangdong Province, but their economic activities account for most or most of Guangdong Province. The Pearl River Delta's GDP accounts for 86% of the province, foreign trade and foreign investment account for 95% of the province, port container throughput and airport passenger throughput both account for 96% of the province, and airport cargo throughput accounts for 99% of the province.

Judging from the figures in 2015, Hong Kong has the largest GDP among the Greater Bay Area, but it is only slightly higher than Guangzhou or Shenzhen. Moreover, the economic growth rate of the Pearl River Delta is much higher than that of Hong Kong. Therefore, the GDP of Guangzhou and Shenzhen will be surpass Hong Kong within two years. Because Hong Kong's population is much smaller than that of Guangzhou and Shenzhen, in the long run, Hong Kong's economic volume cannot be compared with Guangzhou or Shenzhen. Hong Kong's economy can only win based on quality rather than quantity.

Hong Kong's economic advantage lies in its high-quality service industry. The service industry accounts for 92.6% of Hong Kong's GDP, which is much higher than the 54.6% of the Pearl River Delta. Among the nine cities in the Pearl River Delta, Guangzhou and Shenzhen have the highest proportion of service industries, followed by 67.1% and 58.8%, which are still far lower than the level of Hong Kong. Hong Kong's service industry is in a leading position in the Greater Bay Area and the country.

Hong Kong is a world-class service hub and one of the three major international centers of finance, trade and shipping. As can be seen from Table 1, Hong Kong’s foreign direct investment reached US$174.3 billion, seven times that of the nine cities in the Pearl River Delta, and more than US$126.3 billion in mainland China, reflecting Hong Kong’s importance as an international financial center. As a trade center, Hong Kong's total foreign trade is US$987.1 billion, exceeding the US$975.2 billion of the nine cities in the Pearl River Delta. As a shipping center, Hong Kong Airport's cargo throughput is 4.38 million tons, far exceeding the 2.58 million tons of the nine cities in the Pearl River Delta. Hong Kong Airport's passenger throughput also exceeds that of Guangzhou and Shenzhen. The container throughput of Hong Kong port is not as good as that of Shenzhen. Container terminals require a large amount of land, and Hong Kong lacks land, making it difficult to compete with other cities in port freight. Hong Kong should focus on developing high-quality shipping services.

(2) Achievements and limitations of “Front Shop, Back Factory”

1. The output value created by processing exports cannot be ignored

The integration of the Greater Bay Area starts with "front shops and back factories". It is necessary to summarize the achievements and limitations of the "front shops and back factories" model and explore the development of further integration. Since the reform and opening up, China's processing exports have grown rapidly, more than 80% of which come from foreign-funded enterprises. China has become the "world's factory" since Hong Kong businessmen invested in processing and exporting in the Pearl River Delta. Foreign businessmen are responsible for upstream processes (such as order taking, product design, raw material procurement) and downstream processes (such as exports, shipping, financial and insurance arrangements). Mainland producers are mostly responsible for midstream processes (such as processing, packaging, etc.). From 1995 to 2007, processing exports accounted for more than half of mainland exports. As the mainland's export structure upgraded, the proportion of processing exports in total exports began to decline after 2007. Even so, in 2015, the mainland's processing exports still reached US$797.8 billion, accounting for more than one-third of total exports, and Guangdong's processing exports still reached US$280 billion, accounting for 44% of Guangdong's total exports. Its importance cannot be ignored.3

In 2015, Guangdong's exports ranked first in the Mainland, accounting for more than one-sixth of the Mainland's exports; Guangdong's processing exports accounted for more than one-third of the Mainland's processing exports. We do not have processing export figures for the nine Pearl River Delta cities in the Greater Bay Area, but the total exports of the nine Pearl River Delta cities account for more than 95% of exports from Guangdong Province. Therefore, this article uses the processing export figures of Guangdong Province instead of the processing exports of the nine Pearl River Delta cities.

Processing exports have both ends and require the import of a large number of parts or raw materials. Therefore, it is generally believed that the value-added rate of processing exports is low and its contribution to GDP is limited. According to the author's research on the value-added rate of processing exports, this view is actually a partial generalization. To calculate the contribution of exports to GDP, it is not only necessary to calculate the direct value added of exports in the industry, but also to calculate the indirect value added, that is, the value added generated by exports through the use of locally produced intermediate inputs. For example, exports through the use of locally produced electricity, in Value added generated by the power industry. Generally speaking, calculating indirect value added requires the use of input-output tables, which requires a large amount of data and calculations. Fortunately, the author once demonstrated that the gross profit of processing exports (that is, the value of processing exports minus the value of imported raw materials) is slightly higher than the total value added of processing exports, which is a fairly accurate estimate of the total value added. The gross profit of processing exports is very easy to calculate. We can use the estimate of gross profit to replace the estimate of total value added, or we can use the estimate of gross profit margin of processing exports (that is, the gross profit generated per unit of export processing) to replace the estimate of value-added rate.4According to the author's estimation, 2007 was the peak year for processing exports, both in the entire mainland and in Guangdong. The gross profit of processing exports in that year accounted for 22.3% (7.5%) of Guangdong (Mainland) GDP. Until 2015, export processing gross profit still accounted for 10.3% (3.2%) of Guangdong (Mainland) GDP, and the output value created by processing exports still cannot be ignored.

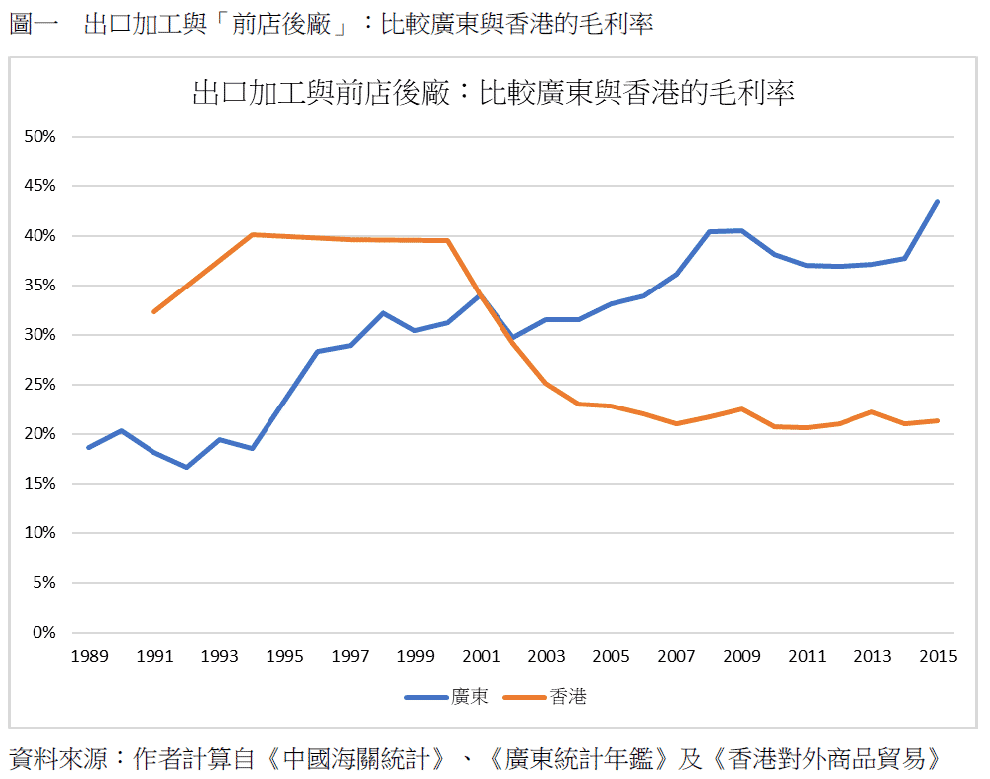

More than 70% of Guangdong's processing exports are conducted through Hong Kong. Guangdong and Hong Kong respectively obtain gross profits from Guangdong's processed products exported through Hong Kong. Guangdong obtains gross profits from processing, while Hong Kong obtains gross profits from upstream or downstream processes (order taking, financial and insurance services, export services, etc.). Figure 1 compares the gross profit margins obtained by Guangdong and Hong Kong from these products, that is, comparing the average gross profit obtained by "front stores" and "back factories" from each unit of Guangdong processed products exported through Hong Kong.5

As can be seen from Figure 1, the gross profit margin of Guangdong's processing exports rose sharply from 19% in 1989 to 43% in 2015, indicating that the upgrade of processing exports was very successful (according to the author's estimation, the gross profit margin of the entire mainland's processing exports also increased rapidly ). The reason for the sharp increase in gross profit margin is mainly that processing exports have expanded from low value-added processes in the midstream to higher value-added processes in the upstream and downstream, replacing imported raw materials and services with locally produced raw materials and services. For example, replacing them with container terminals in Shenzhen Hong Kong’s container terminals (downstream processes), or by taking orders, designing products and procuring raw materials to replace the services of Hong Kong merchants (upstream processes).

In addition, improving product quality and adopting local innovation will also increase the gross profit margin of exports. Figure 1 shows that in the early years, the gross profit margin obtained by Hong Kong from the "front store" process was far higher than that obtained by Guangdong from the "back factory" process. However, with the development of Guangdong's service industry, the processes performed in Guangdong have increasingly expanded, replacing those performed in Hong Kong. As a result, the gross profit margin obtained in Hong Kong is gradually declining, while the gross profit margin obtained in Guangdong is increasing, and in 2001 it exceeded Hong Kong's gross profit margin.

2. "Front shop and back factory" have made an indelible contribution to the economic development of both places.

Hong Kong's gross profit margin from exporting Guangdong's processed products dropped from 40% in 1994 to 21% in 2007, but then remained at a stable level and did not continue to decline. This reflects that although Guangdong replaces Hong Kong's services with local services, Hong Kong has passed The development of high-quality services (such as the development of high value-added logistics services and the use of air transport instead of sea transport) has achieved certain results and can still maintain a gross profit margin of around 20%. The transforming "front shop and back factory" model is still important to Hong Kong's economy.

The contribution of processing exports to the total output value is very considerable. The gross profit earned by Guangdong increased from US$2.4 billion in 1989 (that is, accounting for 6.41% of GDP) to US$46.1 billion in 2004. The proportion of GDP reached the peak in 20%, and subsequently accounted for The share of GDP dropped to 7% in 2015. However, the absolute value of gross profit still increased, reaching as high as 84 billion US dollars in 2015, and it still plays an important role in Guangdong's economy. Hong Kong's gross profit from "front stores" rose from US$6.6 billion in 1991 to US$33.6 billion in 2004, and its proportion to GDP rose from 7.41T to a historical peak in 2015, and then dropped to 131T in 2015. As for the absolute value of gross profit, it rose to a peak of $42.1 billion in 2011 and then stagnated.

In summary, the "shop in front and factory in back" model has driven the economic development of Guangdong and transformed Hong Kong from a low-cost manufacturing center into a service industry hub, making an indelible contribution to the economic development of both places. However, the "front shop and back factory" model also has its limitations. Although the gross profit margin of Guangdong's processing exports has increased rapidly, the technological content of the products is still low. Moreover, global protectionism has become prevalent in recent years and global trade has slowed down. Guangdong cannot rely on exports as a The main engine of economic growth. For Hong Kong, the services provided by Hong Kong are gradually replacing those in Guangdong, and Hong Kong must continue to develop higher-quality services to maintain its status as a service hub. Both Guangdong and Hong Kong need to go beyond the "front shop and back factory" model to successfully build a world-class Greater Bay Area.

For the Pearl River Delta, "stores in front and factories in back" is not a dead end. Export processing has generated huge demand for the service industry, prompting the Pearl River Delta to develop upstream and downstream service industries, and further develop the export of high-tech products through independent innovation. Shenzhen has become a world-renowned base for innovative technology, and Dongguan's exports are also undergoing transformation.

For Hong Kong, "shop in front and factory in back" is not a dead end. In the 1970s, Hong Kong did not have world-class service companies and it was difficult to compete with large international service companies. Later, the huge demand for services in the world's factory in the Pearl River Delta prompted the rapid growth of Hong Kong's service industry, cultivating world-class banks (such as HSBC), real estate companies, conglomerates (such as Hutchison Whampoa), telecommunications companies and airlines ( Cathay Pacific, for example), has the ability to enter the international market. With the opening up of the mainland's service industry and financial industry, Hong Kong's service industry and financial industry can develop to a higher level.

3. Current status and prospects of Hong Kong’s high value-added service industry

Hong Kong needs to develop high value-added service industries in order to coordinate the development of the modern industrial system in the Greater Bay Area. The Hong Kong government has been focusing on the development of four major service industries: trade, finance, professional services and tourism. In 2015, the trade and logistics industry was the largest industry, accounting for 22% of total output value and 20% of total employment. In terms of total output value, the financial industry ranks second, accounting for 18% of total output value. However, the financial industry is not labor-intensive, accounting for only 6.5% of total employment. Professional services ranked third, accounting for 12% of total output value and 14% of total employment. The tourism industry ranks at the bottom of the list of total output value, accounting for only 5% of the total output value. However, the tourism industry is more labor-intensive, accounting for 7% of total employment.6This article will focus on three higher value-added service industries: trade, finance and professional services. The tourism industry is not a high value-added industry. Moreover, Hong Kong’s capacity to receive tourists is close to saturation. The prospects of the tourism industry are not clear, so the tourism industry will not be discussed in this article. among the list.

(1) Hong Kong as a trade center and shipping center

With the rapid rise of the "front shop and back factory" model, Hong Kong's trade and logistics industry surpassed manufacturing to become the largest industry in Hong Kong in the early 1990s. The proportion of trade and logistics industry in total output value rose to a peak of 28.5% in 2005 , however, with the development of mainland container terminals and service industries, the importance of the "front shop and back factory" model has declined. The proportion of trade and logistics industry in Hong Kong's total output value dropped by 5.3 percentage points from 2005 to 2015. However, the trading and logistics industry is still the largest economic industry in Hong Kong.

The mainland's reform and opening up has strengthened Hong Kong's position as a trade hub. The proportion of mainland foreign trade imported and exported through Hong Kong rose sharply from 4.4% in 1979 to nearly 60% in the mid-1990s, an increase of nearly 150 times. However, with the rapid development of the mainland's terminals and logistics industry, the proportion of mainland foreign trade imported and exported through Hong Kong dropped sharply from the peak of 60% in 1997 to the bottom of 22% in 2013.7There are two reasons for the decline in the proportion: First, the Shenzhen container port is developing rapidly and the transportation cost is lower than that of Hong Kong. The freight in the Pearl River Delta is diverted from Hong Kong to Shenzhen. Secondly, after Deng Xiaoping’s historic southern tour in 1992, other provinces followed Guangdong’s export-oriented model. Mainland processing exports expanded from Guangdong to the north to the Yangtze River Delta and the Bohai Bay, and goods from East and North China passed through Shanghai instead of Hong Kong. or northern port export.

In the 1990s, most of the mainland's foreign trade was imported and exported through Hong Kong. This situation was actually abnormal. The mainland's foreign trade is growing very rapidly. China became the world's largest trading country in 2013. It is impossible for most of the foreign trade to be imported and exported through Hong Kong for a long time. In recent years, Hong Kong and Shanghai have been China's two largest trade hubs, each handling about one-fifth of China's foreign trade. This is a relatively normal situation.

Although the proportion of mainland foreign trade imported and exported through Hong Kong dropped rapidly, until 2014, due to the very rapid growth of mainland foreign trade, the absolute amount of mainland foreign trade imported and exported through Hong Kong was still growing rapidly. In the 17 years from 1997 to 2014, the mainland's import and export trade through Hong Kong increased from US$193.7 billion to US$971.4 billion, which was five times that of 1997. The average annual growth rate was as high as 12.2%, indicating that Hong Kong can still provide efficient trade. Serve. The author has demonstrated in detail that based on economies of scale and agglomeration economies in trade activities, large-scale trade centers have strong competitiveness in providing trade and intermediary services. Therefore, international trade is generally concentrated in major trade hubs, while Hong Kong is still It is a major trade hub for the entire mainland and the Greater Bay Area.8

The mainland's foreign trade growth reversed after 2014, falling by 14.3% between 2015 and 2016. The mainland's imports and exports through Hong Kong also declined at the same time, but the decline was smaller. As a result, the proportion of the mainland's imports and exports through Hong Kong rebounded from the bottom of 22% in 2013. 23% in 2015. Looking to the future, although the mainland's foreign trade prospects are beginning to stabilize, the era of rapid growth is clearly over. The prospects for global foreign trade and China's foreign trade are uncertain. Hong Kong has to face competition from neighboring ports. Hong Kong's trade and logistics industry faces very severe challenges.

Container terminals require a lot of land, and Hong Kong is short of land. Compared with mainland ports, Hong Kong is also far away from the mainland's cargo sources, making it difficult to compete with mainland ports. The container handling volume of Hong Kong Port has been surpassed by Singapore, Shanghai, Shenzhen, and Ningbo, and Hong Kong's ranking dropped from first in the world to fifth in the world. Moving and storing goods is not Hong Kong's advantage. Hong Kong should focus on developing high value-added trade and logistics services, headquarters services and trade support services not directly related to moving goods (intermediary services, supply chain management, trade finance, insurance and legal arbitration) , and maintain the flexibility and efficiency of Hong Kong Customs. London's experience shows that seaport throughput and the competitiveness of maritime services are two different things. The throughput of London terminals is negligible, but the competitiveness of London's maritime services is among the highest in the world. The competitiveness of Hong Kong's maritime services is actually very strong. The 2016 Xinhua Baltic International Shipping Center Development Index shows that Singapore ranks first in terms of comprehensive port conditions and maritime services, Hong Kong ranks third after London, and Shanghai ranks sixth.

Hong Kong has made certain achievements in developing high value-added trade and shipping services. Hong Kong has strong competitiveness in air transport. The international cargo volume of Hong Kong Airport has ranked first in the world for many years. The value of air cargo accounts for 41% of Hong Kong’s foreign trade, far exceeding the 19% of sea and river transport. The cargo volume of Hong Kong Airport far exceeds that of the entire Guangdong Province, and the passenger volume also exceeds that of Guangzhou Airport or Shenzhen Airport.

However, Hong Kong Airport is close to saturation, and the third runway will not be available until 2022. The third runway of Guangzhou Baiyun Airport has been completed long ago, and the third runway of Shenzhen Airport will be completed earlier than Hong Kong. Moreover, Guangzhou Airport plans to build fourth and fifth runways, but Hong Kong has no land to build a fourth runway. In the long run, Hong Kong Airport will not be able to compete with Guangzhou Airport in terms of throughput. Hong Kong needs to continuously optimize the management of the airport to maintain high-quality services at Hong Kong Airport. It also needs to cooperate with other airports in the Greater Bay Area. Hong Kong Airport has an excellent international network. However, the network between Hong Kong Airport and mainland cities is not as good as Shenzhen Airport. Hong Kong Airport needs to divide and cooperate with Shenzhen Airport. In addition, Zhuhai Airport has a large amount of spare capacity. Hong Kong should explore cooperation with Zhuhai Airport to handle cargo and open a fast cargo service from Hong Kong Airport to Zhuhai Airport after the completion of the Hong Kong-Zhuhai-Macao Bridge.

(2) Hong Kong as a financial center and service hub

Among the four major service industries in Hong Kong, the fastest growing is the financial industry. From 2000 to 2015, the financial industry's share of total output value increased by 5 percentage points, but its share of total employment increased by only 1 percentage point. The financial industry is not labor-intensive. Therefore, the rapid development of the financial industry can make a significant contribution to the growth of total output value, but its contribution to employment is limited.

The rapid economic growth of the mainland and the reform and opening up of the financial sector are important driving forces for the development of Hong Kong's financial industry. Hong Kong is an international platform for financial interconnection between China and the world. Hong Kong is the primary platform for foreign investment into China: Hong Kong’s proportion of foreign direct investment in China has increased rapidly in recent years, reaching a record-breaking 69% in 2016, surpassing its proportion in the early stages of reform and opening up. Hong Kong is also the primary platform for mainland capital to “go global”: Hong Kong’s share of China’s overseas direct investment has also risen to a high of about 60%. The internationalization of RMB has also driven Hong Kong to become the world's leading offshore RMB center and strengthened the competitiveness of Hong Kong's financial industry.

Since 2015, the mainland's economic slowdown and the depreciation of the renminbi have had an adverse impact on the development of Hong Kong's financial industry. However, the difficulties faced by China's financial reform reflect that Hong Kong's status as China's international financial center is difficult to replace. When capital outflows occur from the Mainland, it is even more necessary to attract foreign investment through Hong Kong, such as using Bond Connect to attract foreign investment, and use Hong Kong's efficient financial market to promote financial reform on the Mainland. The RMB began to stabilize in early 2017, and RMB internationalization has regained momentum. It is believed that Hong Kong's offshore RMB business will develop well.

The City of London has compiled the Global Financial Centers Index (GFCI) since 2007, once every six months. London and New York have been competing for many years, ranking first and second, while Hong Kong and Singapore have alternately ranked third and fourth. From 2007 to 2008, Hong Kong and Singapore scored close to 700 points, while London and New York scored close to 800 points. London and New York are global financial centers, but Hong Kong and Singapore are regional financial centers. There is a certain gap between the two. The global financial crisis in 2008 had a serious impact on the European and American economies, and the scores of London and New York also stagnated. Hong Kong and Singapore have benefited from the rapid economic development in China and Asia, and their scores have increased, and the gap with London and New York has narrowed to about 50 points. Hong Kong is expected to become a global financial center.

From 2000 to 2015, Hong Kong's professional and business services experienced moderate growth, with their share of total output increasing by 1.8 percentage points (and their share of total employment increasing by 2.6 percentage points). Professional and industrial and commercial services are an indispensable part of Hong Kong's role as a service hub. Whether it is a financial center, a trade center, a shipping center, a legal arbitration center or the regional headquarters of multinational companies, they all need the support of professional and industrial services. The reform and opening up of the mainland's service industry and CEPA are both beneficial to Hong Kong's professional and industrial and commercial services.

4. The Greater Bay Area has the conditions to create a world-leading international innovation and technology center

(1) The complementary advantages of Hong Kong and Shenzhen can make the Greater Bay Area a world-class technology bay area

The Greater Bay Area aims to be a global innovation highland, with innovative technology industries led by Shenzhen flexing their muscles in the Pearl River Delta. It is now ready to create a world-leading international innovation and technology center. Looking back at Hong Kong, the development of innovation and technology is lackluster. The first Chief Executive of the Hong Kong Special Administrative Region, Tung Chee-hwa, established the Innovation and Technology Committee when he took office, but the work ended after completing the report one year later. Donald Tsang, who succeeded the Chief Executive, listed innovation and technology as one of the six advantageous industries, but so far the results have been ineffective. The fourth Chief Executive, Leung Chun-ying, had been pushing for many years and finally established the Innovation and Technology Bureau in 2015. The innovation and technology atmosphere has finally gathered pace. Current Chief Executive Carrie Lam Cheng Yuet-ngor attaches great importance to the development of innovation and technology and personally chairs the Innovation and Technology Steering Committee. She believes that even if Hong Kong starts slowly, it can still catch up quickly. In recent years, Sweden's Karolinska Institute's first overseas research center has settled in Hong Kong, and the world's first innovation center of the Massachusetts Institute of Technology in the United States has also chosen Hong Kong. They believe that Hong Kong can connect to mainland China and serve as a bridge, confirming Hong Kong's role as a "super connector" Still going a long way.

Although the scale of Hong Kong's innovation and technology industry is small and slightly eclipsed, and the scientific research investment in 2015 only accounted for 0.76% of GDP, which is not as good as Shenzhen's 4.2% and far lower than neighboring regions such as South Korea, Japan and Singapore, Hong Kong's scientific research With a profound foundation and numerous achievements, its strength cannot be denied. The new SAR government has promised to double scientific research expenditure to 1.51T of GDP by 2022. Moreover, 5 universities in Hong Kong are ranked among the top 100 in the world. International expert review conducted a "scientific research evaluation" in 2014. 12% projects of Hong Kong higher education institutions were rated as "World Leading" and 34% were rated as "International Excellence" , proving that Hong Kong’s scientific research is very competitive.

The "Hong Kong-Shenzhen Innovation and Technology Park" located in the Lok Ma Chau Loop was announced in 2017 and is another "boost in the arm" for the innovation and technology development of the Greater Bay Area. The LMC Loop development plan was launched as early as 1991, and the initiative has experienced twists and turns over the years. The differences in the system, especially the ownership issue, can be resolved. I believe that the conflict of interests and competition between cities in the Greater Bay Area are not inextricable knots. The utilization rate of Cyberport and Science Park is almost saturated. The Loop Science Park is the largest innovation and technology park in history in Hong Kong. It is estimated that the area will create about 40,000 jobs, making up for the land space and human resources urgently needed for innovation and technology development. Hong Kong's innovation and technology system has cultivated the first "unicorn" and has become the focus of the start-up industry and young talents. It is foreseeable that the scale of the innovation and technology industry will become larger and larger, laying the foundation for future development.

In fact, Hong Kong and Shenzhen each have their own advantages in innovation and technology, and complementing each other can make the Greater Bay Area a world-class technology bay area. Hong Kong's scientific research funding mainly relies on government funding and is led by universities, which has nurtured a number of upstream basic research at the international forefront. Shenzhen has both official support and private enterprise donations, and is led by industry to create a number of midstream and downstream applied research with significant social impact. Currently, the two places are actively cultivating a coordinated development ecosystem, combining upstream, midstream and downstream research to transform scientific research into results. Hong Kong's higher education institutions have taken the first step, establishing 8 R&D centers in Shenzhen, setting up 15 companies, and incubating more than 300 companies.

Letting Guangdong, Hong Kong and Macao join hands in scientific research projects will be a breakthrough point for university cooperation. In September 2017, the Ministry of Education released the "Double First-Class" list (world-class universities, first-class disciplines). Guangdong's performance is not outstanding compared to Beijing, Shanghai and Jiangsu. There is great room for cooperation between universities in Guangdong, Hong Kong and Macao. The "Guangdong-Hong Kong-Macao Universities Alliance" was established in 2016 and consists of 26 universities in total, including 10 universities in Guangdong Province, 9 universities in Hong Kong, and 7 universities in Macao. It aims to promote cooperation in scientific research and innovation. This kind of cooperation between universities can give full play to Hong Kong's soft power in higher education, encourage scholars from the three places to jointly apply for national and local research funds, expand resources, and enhance the academic and research status of universities in the region at home and abroad.

(2) Realize the Greater Bay Area industrial chain of "created in Hong Kong, trial production in Shenzhen, and mass production in the Pearl River Delta"

Hong Kong's scientific research has outstanding achievements in the academic world. What needs to be supplemented is the knowledge transfer process that transforms theories into products, thereby generating direct economic benefits. Hong Kong's industry has shrunk and is also limited by land resources, making it difficult to meet the manufacturing capacity required for the commercialization of scientific research. However, once the design is completed, prototypes can be produced in Shenzhen and mass-produced in the Pearl River Delta, where the manufacturing industry is booming. The opportunity of the Greater Bay Area is to realize the industrial chain of "0 to 1" creation in Hong Kong, "1 to 100" trial production in Shenzhen, and "1 million to 1 million" mass production in the Pearl River Delta. This Greater Bay Area industrial chain has taken shape. The "Guangdong-Hong Kong Science and Technology Cooperation Funding Scheme" jointly established by Hong Kong and Guangdong in 2004 has approved 246 projects totaling approximately HK$830 million as of 2016, of which more than Thirty percent is jointly funded by the Guangdong Province or Shenzhen Municipal Government to promote cooperation between universities, research institutions and enterprises in the region for applied research and development and technology transfer.9

Hong Kong, which focuses on high value-added services, will benefit from many of its existing strengths in the development of innovation and technology, including related professional services such as listing financing and intellectual property. Hong Kong remains the world's leading financing platform. Small, medium and micro innovation and technology companies can list on the Hong Kong Growth Enterprise Market or even the Innovation Board, which is still under discussion, and enter the international market. Moreover, Hong Kong’s legal system, which is highly respected and trusted by the international community, is an inherent advantage in becoming an intellectual property trading center in the Asia-Pacific region and controls the lifeblood of the development of innovation and technology in the Greater Bay Area. As of June 2017, the Guangdong-Hong Kong-Macao innovation and entrepreneurship bases located in Nansha, Qianhai and Hengqin have attracted more than 400 young entrepreneurial teams from Guangdong, Hong Kong and Macao, 207 of which are Hong Kong and Macao teams. The three major areas of the Guangdong Free Trade Zone have a total of 158,000 companies, of which nearly 4,700 are Hong Kong-owned, giving the Greater Bay Area a huge customer base with business opportunities.10

To promote industrial cooperation within the region, it is crucial to break down barriers to the flow of factors to ensure unimpeded flow of people, logistics, capital and information. The "Hong Kong-Shenzhen Innovation and Technology Park" not only attracts high-tech talents from across the country, but also attracts top international professionals. The Hong Kong government should consider providing entry-exit convenience measures, such as special short-term visas, for scientific researchers in the Loop.

In addition, cross-border transportation of research equipment and experimental materials will double with the integration of the industrial chain. Improving customs clearance procedures through special channels and reducing approval procedures will help speed up the import and export of related goods.

Furthermore, there are currently strict regulations on the cross-border transfer of scientific research funds, which prevents scientific research institutions from allocating work based on the strengths of each partner unit after receiving funding. Restrictions on fund transfers for scientific research cooperation projects should be relaxed, allowing research funds to flow freely between the three places and be used cross-border.

5. The construction of the Guangdong-Hong Kong-Macao Greater Bay Area and the “One Belt, One Road” initiative will help leverage Hong Kong’s strengths

(1) The entry of Hong Kong’s service industry and financial industry can accelerate the opening up of the Greater Bay Area and the mainland’s service industry and financial industry.

Hong Kong’s role is to develop a world-class service hub and support the development of the Greater Bay Area with high-quality service industries. To achieve this goal, Hong Kong needs to optimize and improve the quality of its service industry, and the Pearl River Delta also needs to open up its service industry market to allow Hong Kong businesses to enter. The goal of CEPA, which was launched in 2003, is to open the mainland's service market to Hong Kong. On the one hand, it will stimulate Hong Kong's economic development, and on the other hand, it will also stimulate the opening and development of the mainland's service industry. Since the development of the mainland's service industry is seriously lagging behind, allowing Hong Kong's service industry to enter the mainland market will help boost the country's service industry. It has been 14 years since 2003, and more than ten supplementary agreements to CEPA have been signed. However, the opening up of the mainland's service industry has not been satisfactory. For Hong Kong businessmen, CEPA only opened the door, but not many small doors.

In 2013, the country established a pilot free trade zone in Shanghai, with the goal of opening up and developing the country's service and financial industries through pilot testing. Subsequently, the trial of free trade zones was expanded to Guangdong, Fujian, and Tianjin in 2015, and to seven other provinces and cities in 2017, bringing the number of free trade zones nationwide to 11. The trial of free trade zones not only reflects the efforts of the central government, but also reflects that the opening and development of the mainland's service industry and financial market have not yet reached the standards.

In fact, the difficulties in opening up the service industry and financial industry far exceed those in opening up commodity trade. In any country, the opening up of the service and financial industries requires a long process. Goods are easy to transport, but services are generally difficult to transport. They require direct contact between consumers (such as tourists) and service producers (such as hotel attendants). Therefore, the barriers to service trade are much higher than those of commodity trade. The main obstacles to tourism trade are transportation and entry restrictions. As for other types of services, most of them must invest in and set up branches in other places (for example, banks set up branches in other places) before they can export services to foreign countries. Therefore, the obstacles to service trade are mainly related to Restrictions on foreign investment access. High value-added service industries, such as banking, finance, insurance, telecommunications, air transport, etc., are often highly monopolized and involve powerful vested interests. These industries are also closely regulated by the government, making it particularly difficult for foreign investment to enter. The integration of the service industry is in-depth and requires the cooperation of policies and supervision from both sides.

Among the opening up of the service industry, the opening up of the financial industry is particularly difficult. An open financial system is vulnerable to attacks by international capital, involves financial risks and the stability of the financial system, and needs to be handled with caution. In terms of the foreign exchange market, the mainland has implemented current account convertibility as early as 1995. At that time, many commentators believed that the mainland could implement capital account convertibility within five years. However, 22 years later, the mainland still has quite strict capital account controls. There is still no timetable for full convertibility.

By the standards of developing countries, China is already quite open, but it has not yet reached the standards of developed countries. Moreover, the mainland's banking, finance, insurance, telecommunications, air transport and other industries are not only highly monopolized, but also involve the vested interests of huge state-owned enterprises. The opening up of the mainland's service industry and financial industry will be difficult and lengthy.

The Guangdong-Hong Kong-Macao Greater Bay Area is the most open and developed region in China. Through CEPA and the Guangdong Pilot Free Trade Zone, Hong Kong's service and financial industries can accelerate the opening up of the Greater Bay Area and the mainland's service and financial industries. The "Guangdong Agreement" under the CEPA framework is piloted and is the first free trade agreement in the mainland designed based on a negative list and pre-establishment national treatment. The mainland's free trade zones and the bilateral investment treaty (BIT) still under negotiation between China and the United States also adopt the same management system. Referring to Hong Kong's experience as a laboratory for China to engage with the international market, it will accelerate the opening up of the mainland's service industry and financial industry.

The "Framework Agreement" of the Greater Bay Area also emphasizes "supporting Guangdong's comprehensive deepening of reform through "first trials and key breakthroughs"... deepening cooperation in a point-to-point manner and fully releasing the dividends of reform", and also emphasizes the implementation of CEPA between the mainland and Hong Kong and Macao and the development of CEPA between the mainland and Hong Kong and Macao. The role of the Guangdong Free Trade Zone is to “promote the development and construction of major Guangdong-Hong Kong-Macao cooperation platforms such as Shenzhen Qianhai, Guangzhou Nansha, and Zhuhai Hengqin, and give full play to its experimental, demonstration and leading role in further deepening reform, expanding opening up, and promoting cooperation. And copy the successful experience of promotion."

(2) The “Belt and Road Initiative” brings opportunities to Hong Kong

In addition to the construction of the Greater Bay Area itself, the "Framework Agreement" of the Greater Bay Area also emphasizes that Hong Kong and Macao "cultivate new advantages in international cooperation" for the country, especially to promote the development of the "Belt and Road": "give full play to the unique advantages of Hong Kong and Macao, deepen cooperation with The countries along the “Belt and Road” will cooperate in the fields of infrastructure connectivity, economy, trade, finance, ecological environmental protection and cultural exchanges to jointly create an important support area for promoting the construction of the “Belt and Road”... to promote the Greater Bay Area in the country’s high-level participation in international cooperation. Play a leading role as an example."

As an international service hub, Hong Kong has assumed the role of supply chain management for countries along the Belt and Road Initiative. In recent years, wages in the Pearl River Delta have skyrocketed and international protectionism has intensified. Processing companies in the Pearl River Delta have moved to the Silk Road areas. Hong Kong is the primary platform for mainland enterprises to "go global" and helps mainland enterprises transfer their production lines to Silk Road regions. Hong Kong has become a service hub for the production chain in the Silk Road regions. Hong Kong's exports to the Silk Road regions have grown rapidly in recent years. On the one hand, this reflects the rapid economic growth in the Silk Road regions. On the other hand, it reflects that mainland manufacturers (including Hong Kong companies with factories in the mainland) have transferred their production lines to Silk Road countries and used Hong Kong as a A service hub for the production chain in the “Belt and Road” region.

The "Belt and Road" initiative has brought considerable economic benefits to Hong Kong. In recent years, Hong Kong’s export performance to India, Vietnam and the United Arab Emirates has been particularly impressive, with most of them being re-exports of mainland products through Hong Kong: In 2016, India surpassed Germany and Taiwan to become Hong Kong’s fourth largest export market (more (overtaking Japan to become Hong Kong’s third largest export market in the first eight months of 2017), Vietnam surpassed the UK, Singapore, South Korea and Germany to become Hong Kong’s sixth largest export market, while the United Arab Emirates jumped from an insignificant market to surpassing the UK to become Hong Kong’s sixth largest export market. Hong Kong is the eleventh largest export market. As a trade center, Hong Kong's function has been upgraded from traditional re-export business to regional supply chain management business. The proportion of mainland China's imports and exports through Hong Kong dropped from the peak of 60% in 1997 to the bottom of 22% in 2013, and then rebounded to 23% in 2015. The rebound in the proportion of mainland China's imports and exports through Hong Kong is believed to be related to Hong Kong becoming a service hub for the production chain of the "Belt and Road" region.

Hong Kong's role in the country's foreign economic strategy actually goes far beyond finance, professional services, shipping, logistics and legal arbitration. International relations in the 21st century, in addition to "hard power" such as military, political, and economic, must also pay attention to the "soft power" of culture and media. The mainland's social organizations are mainly top-down, and civil society is not active enough, which hinders the development of "soft power" and weakens China's voice in the international community. Hong Kong has always been the most international city in the country. It is also a bridge between Eastern and Western cultures. It is an international media center and a city where many international civil groups (including NGOs) gather. It is good at adapting to and handling the contradictions of a multicultural society.

What the mainland lacks is Hong Kong's strength. Hong Kong provides the country with a diversified external platform of "soft power". The "Belt and Road" initiative emphasizes "people-to-people connectivity", and the "Framework Agreement" of the Guangdong-Hong Kong-Macao Greater Bay Area also emphasizes "cooperation in the fields of ecological environmental protection and people-to-people exchanges." Projects invested in the Belt and Road Initiative will receive great attention from the international media and many civil society groups (including environmental groups). A country must be good at dealing with international media and civil society organizations in various countries in order to successfully expand its foreign economic strategy. The state can exert influence through Hong Kong's international media and international civil society networks. Hong Kong has many overseas Chinese communities from Southeast Asia and around the world. The country can expand its external relations through these overseas Chinese communities. Hong Kong is an education hub, with its universities ranking very well internationally and ranking highly in the QS Global "Best Student Cities". Foreign students are willing to come here to study, and Hong Kong can play its role as an international education platform.

All in all, Hong Kong is the most open city in the country. China's active participation in global economic governance, the development of the Guangdong-Hong Kong-Macao Greater Bay Area and the "One Belt, One Road" initiative are conducive to Hong Kong's strengths. Hong Kong needs to maintain and enhance the competitiveness of its international platform and further develop its unique strengths of "one country, two systems", especially Hong Kong's advantages in economic freedom, press freedom, information freedom and government integrity and transparency, as well as maintaining a fair and open business environment and A fair judicial system. To this end, the central and SAR governments must conscientiously implement the various guarantees for freedom, human rights and the rule of law in the Basic Law in Hong Kong.

In Li Xiaohui et al., eds.: "Guangdong-Hong Kong-Macao Greater Bay Area and Hong Kong", Hong Kong, The Commercial Press, 2018 edition, pp. 312-337.

Song Enrong, Deputy Director of the Shanghai-Hong Kong Development Joint Research Institute of the Chinese University of Hong Kong and Co-Convener of Democratic Thoughts (Research)

Pan Xuezhi Research Assistant, Shanghai-Hong Kong Development Institute, The Chinese University of Hong Kong

Comment

1 Liu Maijiaxuan and Tam Xiaolin: "Guangdong-Hong Kong-Macao Greater Bay Area-History, Significance and Hong Kong's Positioning", Hong Kong Economic Times, May 11, 2017, page B10.

2 Due to space limitations, among the nine cities in the Pearl River Delta, the table only lists the economic indicators of Guangzhou and Shenzhen, while omitting the indicators of the other seven cities.

3 Data comes from "China Customs Statistics" and "Guangdong Statistical Yearbook".

4 Yun-Wing Sung, “Made in China: From World Sweatshop to a Global Manufacturing Center?”, (2007) Asian Economic Papers, Fall 2007, 43-72.

5 See Note 3 for estimation methods.

6 From the statistics of the four major industries of the Hong Kong Census and Statistics Department, the total output value only includes direct value added and does not include indirect value added. The author previously used the concepts of "total value added" and "gross profit", which include direct and indirect value added.

7 China’s foreign trade imports and exports through Hong Kong include re-export trade through Hong Kong, as well as Hong Kong’s offshore trade (that is, trade directly imported and exported by Hong Kong merchants from ports outside Hong Kong without going through Hong Kong Customs, such as exports by Hong Kong merchants from Shenzhen Yantian Port) trade to the United States), for detailed calculation methods, see Yun-Wing Sung, “Hong Kong and Shanghai as Global Service Hubs: Rivalry or Complementarity?” Occasional Paper No. 20, (Shanghai-Hong Kong Development Institute, Chinese University of Hong Kong , 2009), 12-15. Available at https://www.researchgate.net/publication/298453954_Hong_Kong_and_Shanghai_as_Global_service_hubs_Rivalry_or_complementarity.

8 Yun-Wing Sung, The China-Hong Kong Connection: The Key to China's Open-Door Policy, (Cambridge University Press, 1991), pp 123-63.

9 Legislative Council Panel on Commerce and Industry, "Documents provided by the Government on the 19th Meeting of the Guangdong-Hong Kong Co-operation Joint Conference", September 14, 2016, source: http://www.legco.gov.hk/yr16-17/chinese/panels/ci/papers/cicb1-39-1-c.pdf (Last accessed: October 17, 2017).

10 "Guangdong Free Trade Zone becomes the "pioneer force" for in-depth cooperation between Guangdong and Hong Kong", "Xinhuanet", June 28, 2017, data source:http://news.xinhuanet.com/2017-06/28/c_1121229318.htm (Last accessed: October 17, 2017).

Data link

1. Cities under separate planning

Cities under independent state planning, whose full name is cities under separate state planning for social and economic development, are cities in mainland China where provincial-level units delegate some economic management authority to large cities under their jurisdiction, while cities under separate state planning still retain the administrative status of provincial municipalities. The city's revenue and expenditure are directly linked to the central government and are divided between central finance and local finance. They do not need to be turned over to provincial finance and have a high degree of financial freedom. In the 1950s and 1960s, the mainland implemented a system of separately planned cities. However, after several changes and cancellations, the current system was established in the 1980s. As provincial capital cities cancel cities under separate state planning and establish "sub-provincial cities" at the same time, the number of cities under separate state planning continues to decrease. Currently, there are only five cities left under separate national planning status: Dalian, Qingdao, Ningbo, Xiamen, and Shenzhen.

2. "Front shop and back factory"

"Front shop, back factory" was the mainstream model of economic cooperation in the Pearl River Delta, Hong Kong and Macao in the early stages of reform and opening up. Due to the lower labor and production costs in the Mainland at that time, many Hong Kong manufacturers set up factories and production lines in the Pearl River Delta region, and then used Hong Kong as their storefronts and transit points to earn profits by exporting and selling their products to other places through Hong Kong companies. However, with the rise in operating costs on the mainland, the transformation of the Pearl River Delta's economic structure, and China's accession to the WTO, Hong Kong's manufacturing industry has gradually moved its processing processes to lower-cost inland provinces and regions. Cities such as Guangzhou and Shenzhen have also become more mature, and there is no need to resort to Hong Kong export goods. The business model of "store in front and factory in back" is gradually declining.

3. "Unicorn"

"Unicorns" refer to unlisted technology start-ups that have been established for less than 10 years but have a valuation of more than US$1 billion. They are regarded as an important indicator of the development of the new economy and represent the degree of activity in converting technology into market applications. According to data from CB Insights, a private enterprise research organization, as of October 2017, there were 216 unicorns in the world, about half of which were from the United States, while China accounted for a quarter. Among the top ten “unicorns” based on company valuation, the United States accounts for six and China accounts for four. The world's largest "unicorn" is "Uber", ranking first with a valuation of US$68 billion, "Didi Chuxing" ranking second with a valuation of US$50 billion, and "Xiaomi" with a valuation of US$46 billion. Ranked third in value.